what is limited fsa health care

What is a limited purpose health care spending account. If youre enrolled in a qualified high-deductible health plan and have.

Kiss Yoga Studio Great News If You Have A Fsa Or Hsa You Can Use The Tax Free Funds To Pay For It Read The Following To Find Out How How Can

However you will be able to make contributions to an HSA or FSA if you are.

. A Limited Purpose FSA is a Flexible Spending Account FSA that is compatible with a Health Savings Account HSA. A Limited Purpose FSA is referred as this because it is. Designed only for submitting eligible dental and vision expenses the Limited Expense HCFSA is used as a replacement for the old good HCFSA when the participant.

A Health Savings Account HSA is an investment account available only to members who are enrolled in a High Deductible. A Limited Purpose FSA is a healthcare spending account that can only be used for eligible vision and dental expenses. There are three types.

Learn about FSAs flexible spending accounts how FSAs work what they are and how they may help you cover out-of-pocket medical expenses. Rather than a Healthcare FSA. Offered through your employer an FSA is a smart income tax-free way to help you pay for eligible medical expenses.

Only certain medical expenses are covered through a. A Limited Expense Flexible Spending Account also known as a limited purpose FSA is another type of pretax health account. If the FSA is a general purpose Health Care FSA that pays or reimburses for qualified medical expenses.

FSAFEDS offers a Limited Expense Health Care Flexible Spending Account LEX HCFSA for eligible employees in FEHB high deductible health plans HDHP with a health savings. Facts about Flexible Spending Accounts FSA They are limited to 3050 per year per employer. Various Eligible Expenses You can use your Limited Expense Health.

A Limited Purpose FSA is similar to a Healthcare FSA in that it acts as a tax-advantaged spending account for health-related expenses. By eliminating the need to use your HSA funds for these. 16 rows Your Limited Expense Health Care FSA pays for qualifying dental and vision services and certain products.

If youre enrolled in an HSA-qualified high-deductible health plan and have a Health Savings Account HSA you can increase your savings with a Limited Expense Health Care FSA. If youre married your spouse can put up to 3050 in an FSA with their employer too. A Flexible Spending Account FSA is an employee benefit that allows you to set aside money on a pre-tax basis for certain health care and dependent care expenses.

A Limited Purpose FSA is a Flexible Spending Account FSA that is compatible with a Health Savings Account HSA. A Limited Expense Health Care FSA LEX HCFSA is used in place of the general purpose Health Care FSA if the participant enrolled in a High Deductible Health Plan with a. A Limited Purpose FSA is a Flexible Spending Account FSA that is compatible with a Health Savings Account HSA.

A limited-purpose flexible spending account LPFSA is an employer-sponsored account primarily used to pay for vision and dental expenses not. Every pay date an allotment is deposited directly into your FSA. The method of funding.

Its simple to enroll. Decide how much you want to set aside from. Differences between a Health Care FSA a Limited Purpose FSA a Dependent Care FSA The coverage of eligible expenses.

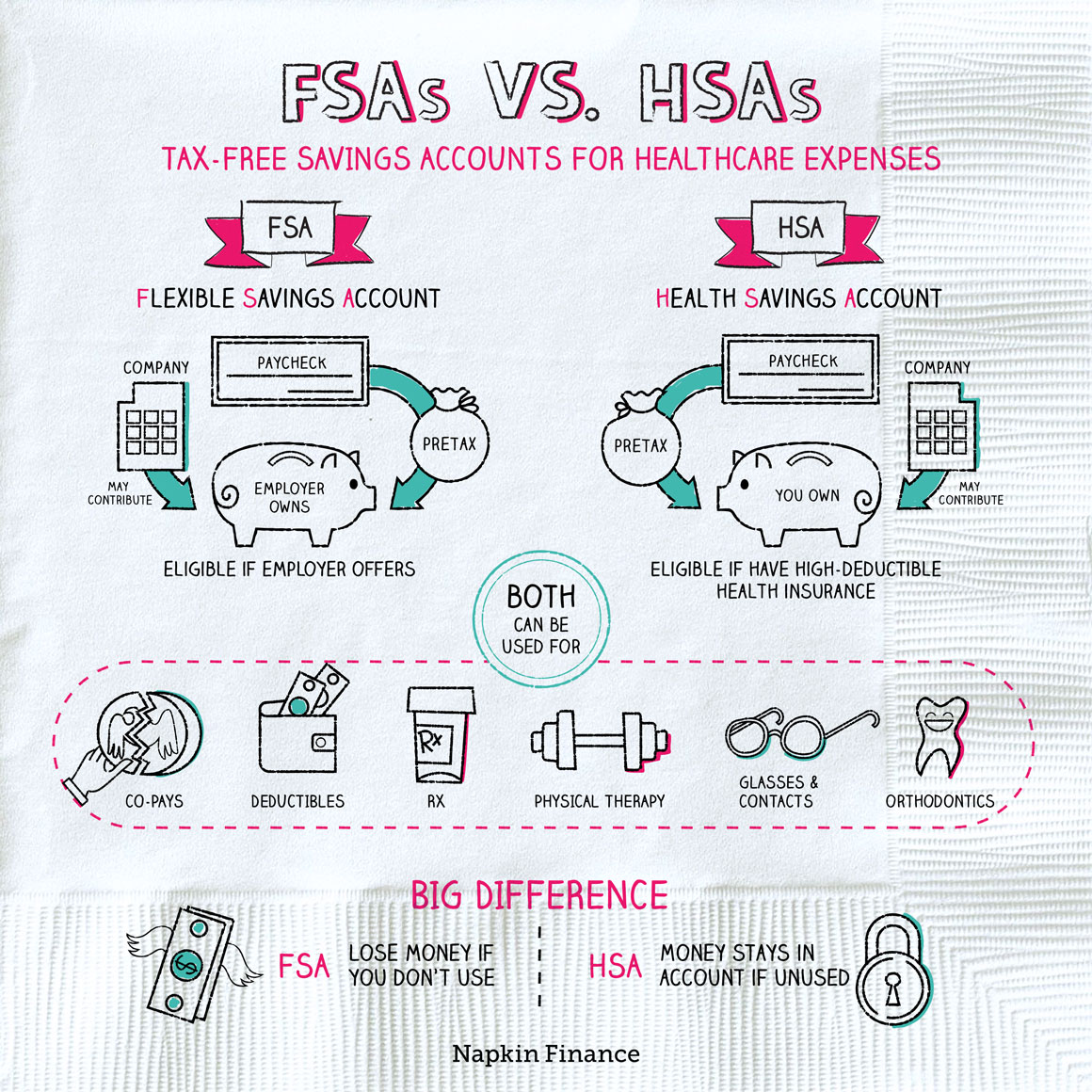

What Are Fsas Vs Hsas Napkin Finance

Navia Benefits Limited Health Care Fsa

Healthcare Fsa Vs Hsa Understanding The Differences Forbes Advisor

Navia Benefits Limited Health Care Fsa

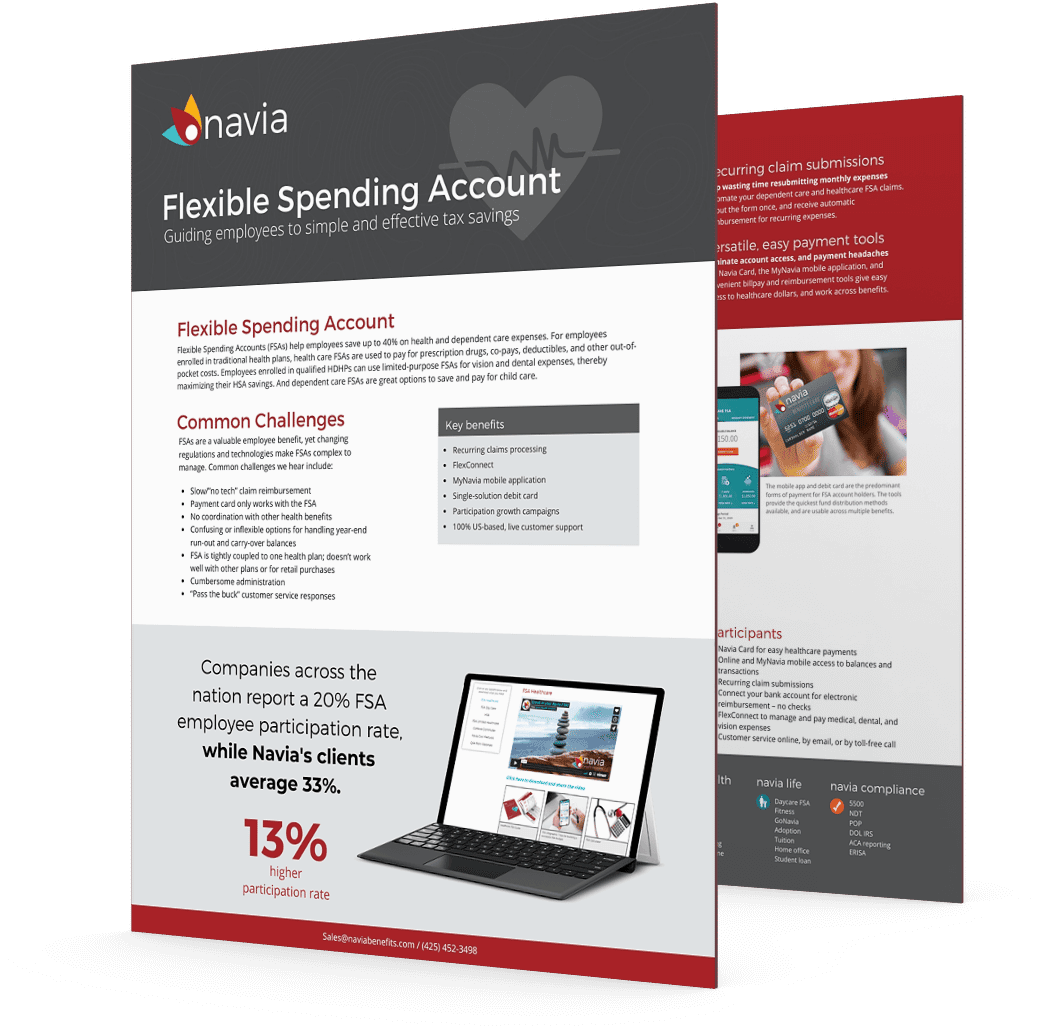

Navia Benefits Health Care Fsa

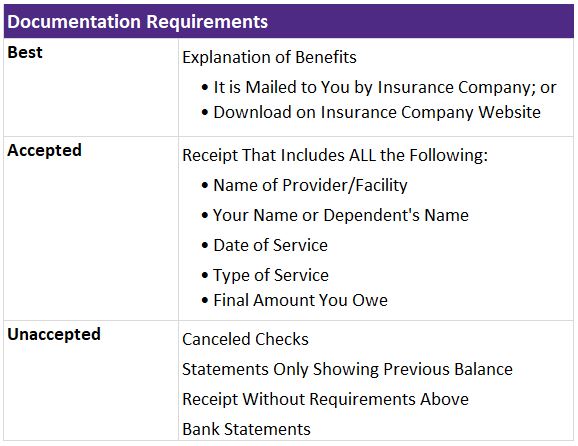

Health Care And Limited Use Fsa Human Resources Northwestern University

What Is A Limited Purpose Fsa And How Does It Work Goodrx

Hsa Vs Fsa What S The Difference The Retirement Solution Inc Financial Advisors Retirement Planning

Using A Limited Purpose Fsa In Conjunction With Your Hsa National Benefit Services

Limited Purpose Fsa Lpfsa Optum Financial

Flexible Spending Accounts Fsa State Employee Health Plan

Understanding The Limited Purpose Fsa Datapath Administrative Services

Where Can I Use My Fsa Debit Card Lively

Health Cards Healthcare Hsa Fsa Or Hra Cards Visa

2021 Fsa Contribution Cap Stays At 2 750 Other Limits Tick Up

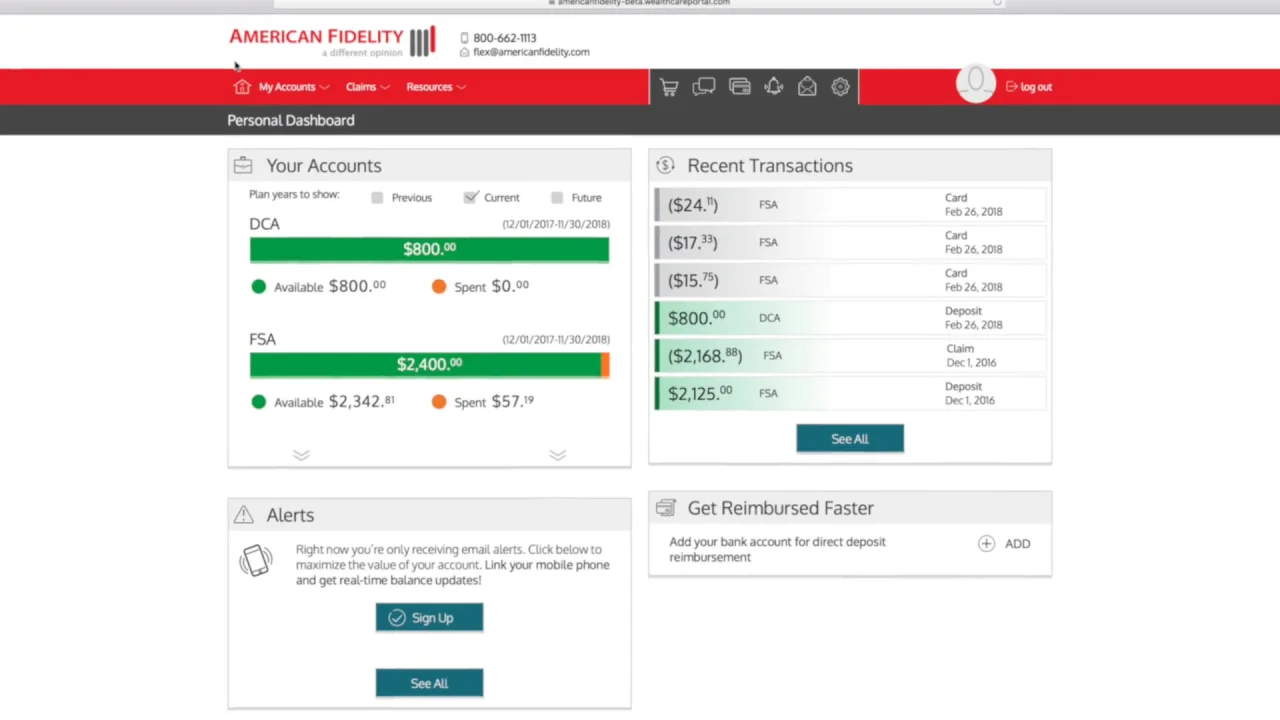

Healthcare Fsa Support American Fidelity

There Are Many Benefits Of Having A Flexible Spending Account Taxes Fsa Flexiblebenefits Health Flexibility Accounting Benefit